I would not go so far to say that Electric Vehicles (EVs) are the future, but they are certainly a part of it. We are definitely moving from a world in which cars are powered by petrol to a better world, where they are going to be powered by cleaner fuels.

I would like to talk about EVs mostly today, even though they are not the only game in town. Sorry about the long post, but I think I have spotted an opportunity here and hence would like to discuss it a little further.

Little by little the total cost of EVs is coming down, making them more affordable. According to The Economist, total cost of ownership of an EV is to become cheaper than the gasoline cars from 2018 onwards. This might be a turning point in the EV history.

EVs are not only cool in which they are environment friendly (one can argue that they are powered by coal, but still the pollution should be less than a petrol-run vehicle), but they are also modern and fast (Tesla model S accelerates from o to 100km/h in less than 3seconds, so the company says).

Despite that, the electric car is extremely dependent on government subsidies. The federal tax credit for an EV purchased for use in the US is from $2,500 to $7,500 per vehicle, depending on the size of the vehicle and its battery capacity, for up to 200,000 vehicles sold by that maker. Depending on where one lives, there are still incentives from the state and city. I am talking about a $1.5 billion in tax incentives from the federal government only – not something to sneeze at.

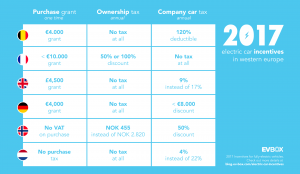

And if one crosses the pond, things do not get too bad for the EV makers also. Norway, for instance, does not charge a purchase tax and gives ownership taxes discounts for EVs – not to mention the free parking, free tolls, free recharging network, etc. A quick summary of the benefits in a few European countries is provided on the chart below (more info on http://blog.ev-box.com/electric-car-incentives/).

I believe policy support will remain important for the foreseeable future, as governments want to foster a new and cleaner technology. But once the adoption of these new technologies reaches a certain level, subsidies will have to recede. As the number of adopters grows, the government´s revenues will decline (as there are less high-tax petrol-run vehicles and more low-tax EVs) and we all know how well governments deal with low taxes… But I digress.

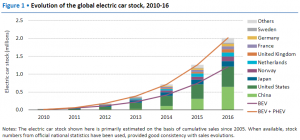

The point is that the EV market is growing and is growing fast. In 2015, there were just over 1 million vehicles in circulation. This number jumped to 2 million in 2016 and should surpass 3 million at the end of 2017 (I do not have the final number yet, only guesstimates, but you get the point, the industry is growing).

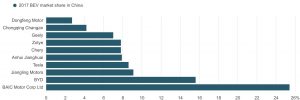

An interesting fact: the US is not the world´s biggest user of the new technology, China is. Including electric two-wheelers, electric vehicles and more than 300 thousand electric buses, the Asian country is the number one – hence, all EV makers have to have a presence there. Besides, there are less than 17 cars per 100 people, which indicates that the penetration should grow from here. Plus, judging by the pollution in the cities, the government will continue to support this EV revolution.

Looking at the Chinese market, we can see Tesla is doing pretty well, taking 9% of the market, well ahead of any foreign competitor, despite not having access to all subsidies and being subject to a 25% import duty. BYD, the company owned by famous investor Warren Buffett, has more than 15% of the Chinese electric vehicle market.

Another interesting fact is that sales of EVs happen mostly in only 10 countries in the world, being China, the US, Japan, Canada, Norway, the UK, France, Germany, the Netherlands and Sweden.

In regards to the cars themselves, batteries and software are probably the most important things to look at in the industry. Batteries have a finite life spam and represent most of the EV´s cost (circa 40%). Battery prices have come down substantially in the past few years and they are supposed to remain on a down cycle for the next few years. A study published by Bloomberg New Energy Finance (BNEF) said “Lithium-ion battery costs have already dropped by 65% since 2010, reaching $350 per kWh last year. We expect EV battery costs to be well below $120 per kWh by 2030, and to fall further after that as new chemistries come in.”

After all this talk of KWh, to make things simpler (not correct, not accurate – there are many different things to look at, as battery makers, car weights, acceleration, type of road, etc) we can assume that an electric car´s battery achieves about 8.0 km/kWh. Hence, it´s important to know what is the KWh of the car we are looking at.

I got the following data from Wikipedia:

Battery Capacity: Full-electric

- BMW i3: 22–33 kWh

- BYD e6: 60–82 kWh

- Chevrolet Bolt / Opel Ampera-e: 60 kWh

- Citroen C-Zero / Peugeot iOn (i.MIEV): 14 kWh (2011) / 16 kWh (2012-)

- Fiat 500e: 24 kWh

- Ford Focus Electric: 23 kWh (2012), 33.5 kWh (2018)

- Honda Clarity (2018): 25.5 kWh

- Hyundai Kona Electric: 64 kW

- Kia Soul EV (2016) 27 kWh

- Nissan Leaf I: 24–30 kWh

- Nissan Leaf II: 40 kWh (60 kWh in future option)

- Mitsubishi i-MIEV: 16 kWh

- Renault Fluence Z.E.: 22 kWh

- Renault Twizy: 6 kWh

- Renault Zoe: 22 kWh (2012), 41 kWh (2016)

- Smart electric drive II: 16.5 kWh

- Smart electric drive III: 17.6 kWh

- Tesla Model S: 60–100 kWh

- Tesla Model X: 60–100 kWh

- Tesla Model 3: 50–70 kWh

- Toyota RAV4 EV: 27.4 kWh (1997), 41.8 kWh (2012)

- Volkswagen e-Golf: 24–36 kWh

This list is also good because it provides us with the electric vehicles that we want to look at (not hybrids). I also would like to mention the Porsche mission E, the Jaguar i-Pace and the Audi e-tron. Together with BMW, I believe these are the ones which are going to bring more excitement to the market.

So let´s start with the Model X, an SUV made by Tesla, launched in 2015. The company says it has an autonomy of up to 295miles (approximately 470km) and it costs around $84,000 (the price can go up substantially from here, depending on the add-ons).

Tesla also makes a sedan, called Model S, which has an autonomy of up to 335 miles (circa 540km) and costs around $83,000 (also, the price can go up substantially from here, depending on the add-ons). This vehicle was launched in 2012.

These cars are (were) really second-to-none. I have personally visited a Tesla to check them out and was really impressed. The pictures do not give justice to the cars, they are way more beautiful personally. Well, that´s what you should expect from a pricey car, anyway. Below are the quarterly sales of each one of those models:

| Model X | Model S | |

| Q3 2015 | 6 | 11.597 |

| Q4 2015 | 206 | 17.272 |

| Q1 2016 | 2.400 | 12.420 |

| Q2 2016 | 4.638 | 9.464 |

| Q3 2016 | 8.774 | 16.047 |

| Q4 2016 | 9.500 | 12.700 |

| Q1 2017 | 11.550 | 13.450 |

| Q2 2017 | 10.000 | 12.000 |

| Q3 2017 | 11.865 | 14.065 |

| Q4 2017 | 13.120 | 15.200 |

As one can suspect, the sales are not bigger because of the price tags – and bottlenecks in the factories.

Last, but not least, there is Model 3, which Musk wanted to call Model E – so the 3 cars would spell S-E-X, but he had trouble with that (apparently Ford has the rights to the name). Model 3 is supposed to be a mass-market car, the one which would put Tesla on a profitable path – we will see about that.

The intention was that the starting price for a Model 3 would be $35,000, so it would be attractive to the majority of buyers who wanted and electric car, but have not the money to pay $80,000+ for another Tesla model. The autonomy of the standard Model 3 is around 350km, lower than the other models, but still very impressive.

So, I went to the website to try to buy one, and this is what I found: the price really starts at $35,000, but once you add the options that you want, the price can go substantially north of that (almost $60,000). And a $1,000 reservation fee is due when you place your order.

Now, the technology to build the Model 3 is similar to the technology needed to build the other Models, but this one will cost substantially less than the other ones – how can it be?

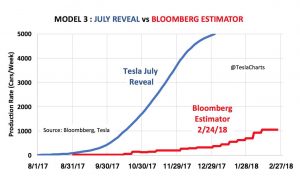

Tesla is having problems with the ramp up of the production of Model 3. Actually, that has been a trait of this company for a long time, the CEO makes some promises and does not deliver. In July, Musk tweeted that Tesla would produce 20,000 per month of the Model 3 by December – and that is after a shocking reduction from a year earlier, when the estimate was 100,000 – 200,000 Model 3 in the second half of 2017. Well, that number came to 2,425 cars produced in the quarter (October, November and December). Somehow, the markets have given Tesla an “out of jail card” in regards to broken promises, but until when?

In the run up to the launch of Model 3, Tesla´s sales of existing models did not grow (surprise, surprise), something that disappointed investors. There might be a cannibalization of sales within the company, where customers refrain from buying expensive luxurious cars to buy the cheap Model 3 – to say the least, which should not be good for the company´s profitability.

The problems with the production of Model 3 in the Gigafactory 1 seems to be a challenge to Musk. Tesla said in November last year that the main constraint was its battery module assembly line at its Nevada Gigafactory – and what happened next? Tesla’s director of battery engineering, Jon Wagner, left the electric car manufacturer. In the latest investors call, Musk refused to point out whether the problem was the software, the batteries or the robots – machines that make the machines.

At the end of the day, the electric vehicle is very modern, with lots of inputs from breakthrough batteries and software, but it has to go through an assembly line, like every other factory-manufactured product (some sceptics would say that Tesla´s cars are handmade, but I am not getting involved in that). And tech people, intelligent and visionary as they are, may not be the best to deal with assembly lines.

As much as people want to say that it is a technology company, it is still based on the assembly line and bottlenecks need to be addressed. They are most likely not a strong suit of the flamboyant CEO.

And below is a chart from Bloomberg (which I got from Grant Williams tweeter) showing the “ramp-up” (is it what they call it?) in Model 3 production.

Not to mention that competition is heating up, at a moment when Federal Government tax incentives to Tesla are waning (estimated mid-2018) and are about to start for the competition. And the competition is picking up, with new launches in 2018 by the likes of Jaguar, Audi, BMW, Faraday (although this one has been promising a launch for a few years now), to name a few. Porsche is expected to launch its Mission-E by next year and by 2020 there are going to be even more, with Volkswagen, Volvo and GM entering this market.

Besides, the batteries themselves could change rapidly. Toyota launched a car that uses hydrogen as a fuel (https://ssl.toyota.com/mirai/assets/modules/carpageallfeatures/docs/MY18_Mirai_eBrochure_Lifestyle.pdf). The only emission is water and the car takes only 5 minutes to recharge – a big improvement from the recharging time of the EVs.

The fact is that Tesla has burnt through a lot of cash since its foundation, and the pace has accelerated over the last couple of years. According to Bloomberg, the company “has been burning money at a clip of about $8,000 a minute (or $480,000 an hour)”. Actually, Tesla has already burnt circa $9 billion since the IPO. Again, the markets have given Tesla an “out of jail card” also in regards to capital raisings, some comparing the company today to the early days of Amazon (there are many differences in my mind, like profitability, no competition, no government subsidies, less key-personnel turnover, etc, but that may be only me).

I found out that the investor base for Tesla is very different from the investor base of the other car companies. In my opinion, for two reasons: first, people that invest in the big car companies rely on their annual dividends; secondly, the management and Boards of these big car companies are in their late 50s or 60s, meaning that they do not have too much time until retirement. If they decide to reduce their companies´ profitability by investing heavily in an EV, their bonuses will also be reduced. Tesla does not face any of these problems with their investor base, which are confident in the growth of the company and are happy to wait for the profits (that may never come).

Also, a little advantage that Tesla has in regards to these big auto companies is their asset base. Tesla, being a 100% EV manufacturer, does not have the big plants that Mercedes, Audi and others have. Contrary to the main thought, these big factories might become obsolete in the near future and turn to be a drag on the companies´ profitability. They might, if EV is really the future and the future arrives fast, with little time for these companies to adapt.

Another interesting characteristic of Tesla is the autopilot function. As work-in-progress software, there are some glitches: https://www.youtube.com/watch?v=QyMBTXpNOhg and crashes: https://www.youtube.com/watch?v=mEGAH330SCY . This function is still very limited and is supposed to work on nice straight freeways – with someone behind the wheel paying attention to the road.

Tesla is not the only one trying self-driving cars. Volvo, Nissan, Cadillac, Mercedes and Audi are in this market. And Volvo and Audi have also been involved in accidents. The U.S. National Transportation Safety Board is investigating Tesla for the latest accident, in January. But it has refused to issue a recall or fine Tesla.

In my opinion and after talking to people in the sector, it is unlikely that Tesla will have problems with the agencies regarding the autopilot function. It is ranked 2 in a scale from 1 to 5, where 5 is a fully self-driving vehicle. Nor do I believe Tesla will be obliged to issue a recall (because of the autopilot).

A point that I think is forgotten in this story is excessive regulation. Major companies may force the government to oblige car manufacturers to include more expensive systems and pieces in the cars to try and force Tesla to spend capital it does not have and decrease its already low gross margins. With the amount of debt that Tesla has, a decreasing gross margin combined with “production hell” can be fatal to the company.

Looking at the competition, one thing is very clear; all of these car makers do something that Tesla does not do: make profits! And this could be a game changer at the end of the day. Making money means one does not depend on the stock and bond markets to finance your every project. These markets have been very keen to give Tesla all the money it needed over the past few years, but they also close from time to time in unpredictable ways and it is a very worrisome trait to rely on financial markets to keep one´s company going.

Actually, the company has been on the brink of bankruptcy a few times over the last few years. Since then, Tesla brought on board important investors that, together with Elon Musk, gave the company more credibility. In 2007, Google co-founders Sergey Brin and Larry Page participated in a round of financing. In 2009 and 2010, Daimler also helped, investing circa $50million in the company. The next year, it was Toyota´s turn to invest a similar amount. Also, in 2010, Tesla received US$465 million in low-interest loans from the United States Department of Energy.

But the capital raising never stopped. There was the IPO in 2010, a few stock and bond offerings since, to help pay for the GigaFactory, new launches, superchargers network and acquisitions, like Grohmann and SolarCity.

SolarCity was acquired (or bailed out, as you prefer) by $2.6billion in stock at the end of 2016 and it brings to Tesla… more losses. Thanks to the discontinued fillings for SolarCity, it is now impossible to know for sure what the losses are, but one can look into the latest 10-k (for 2016) and see that the debt under SolarCity and its subsidiaries was, at that time, $3.6 billion. I have not looked yet at all the covenants of the debt, but certainly there are some clauses that qualify as a default, which would accelerate the rate of repayment of the debt.

And something is strange over there: it´s not easy to contact the Investors Relations people – I tried (and I have to confess, I did not try hard).

To be fair to Tesla, its revenues have increased at a strong pace, turning the company into the biggest success (measuring by revenues only) since Google or Facebook. This, obviously, because not FB or GOOG have the level of expenditures that Tesla has. Tesla was able to reduce its CAPEX in comparison to next year´s revenues. So, one could argue that the company is investing for growth and the more the company invests, the more growth it sees.

Now, with another $3.5 billion in CAPEX expected in 2018, Tesla will most likely need another round of financing. Obviously, the sooner they raise this capital, the better, as conditions might deteriorate in the next few months. Also, I did not understand why Elon did not raise capital through a share issue last year, when there was less sound of competition and the share price was hitting all-time-highs.

Long-term debt is now at $9.4 billion and the short-term debt is $900 million, according to the latest 10-k. It does not include the $500 million in asset-backed debt the company issued in January 2018. Even if the company does not increase its borrowing from here, the cost of servicing this debt is set to rise as US interest rates go up.

Volatility is back in this market and, in spite of a selloff in the equity markets in February, things seem to be OK for now. But we are on the 10th year of this bull market, the second longest in our lives. A crisis is due and risks abound. But I do not want to make predictions about the markets, it´s enough to look at the company and see what it is doing.

And one would imagine that, with so much on Elon´s plate, he would try to focus on resolving the problems before taking on new ventures. But, that could not be further from the truth. Tesla did not stop with the 4 models it had. More than that, it ventured itself into new markets inside the transportation business, with the semi-truck and the new roadster – something that will require even more capital raising – apparently, something that Tesla counts on.

Elon Musk has no doubt had a superb career and impact in the world. But today he has so many projects under his supervision, that begs the question if he will be able to deliver it all. So far and at the same time he has been involved with Tesla, SpaceX, the Boring Company, colonizing (and retiring in) Mars, batteries (Solar City), OpenAI, Hyperloop and, on top of it all, a great caps and flamethrowers salesman.

According to Peter Thiel, Elon Musk is the same as president Trump “They’re both grandmaster-level salespeople and these very much larger-than-life figures”. Well, if I didn´t know what to think about Elon Musk´s latest compensation package, the definition above helps a lot.

Musk will not receive any salaries or bonuses, but will receive 1% per tranche (making it 12%, as there are 12 tranches) of the total current outstanding shares if a couple of conditions are met: market cap has to increase to $100 billion and in increments of $50 billion from there onwards (meaning that, for Elon Musk to fully vest in the award, Tesla´s market cap must increase to at least $650 billion – or, putting it in another way, the company would be worth in today´s money one Pfizer, one Nestle and one Shell. The second condition is related to revenue and EBITDA (I´m sorry, adjusted EBITDA) targets.

Stories that I´ve heard and read show that Elon, the CEO of Paypal, was burning through $10 million plus every month and was removed from office during a vacation to Australia. Roloef Botha, the CFO of Paypal at that time, said that the company would not have lasted 6 more months with Elon at his helm.

Like Nikola Tesla, the famous inventor whose eccentric personality and ultimate goals for science made people think that he was crazy, the car company that carries his name looks like it will make justice to his legacy and have the same fate: broke at the end!

Excellent text , very interesting to read and think about EVs future !!!

Congrats

Mais um excelente texto!!